Today's Agenda: Follow the Money

Presented by Payment Labs

Publisher’s Message

Welcome to the inaugural issue of The Athlete's Bureau (TAB)— a values-driven business newsletter for college athletes and those that care about them.

Over the first couple of years of the NIL era, I have been very fortunate to learn a lot from my successes and failures. TAB will be a space where I share those insights, enlisting the help of award-winning college journalists and industry leading Gen Z pollsters to educate and advocate for like minded college students. Most importantly, I will be amplifying the perspectives of the most precious resource in college sports - the athletes.

College athletes represent some of the most ambitious, thoughtful, and accomplished students at the finest universities in the country. We are more than capable of speaking for ourselves.

While athletes’ bodies are the fuel that drives college athletics, far too often our intellect, hustle, and voices have been ignored. The Athlete’s Bureau intends to change that. How we will use our voices to create value for all stakeholders in college athletics will be operationally defined in each issue.

I am excited you’re here on this journey with us!

Best,

#BE11EVE #NILforGood #PayTAB

P.S. The decision to launch on All Vote, No Play Day is intentional, but future issues will likely be delivered on Sunday mornings with special posts delivered as the need arises.

Follow The Money

By Alex Wakefield, TAB Media Rights Contributor

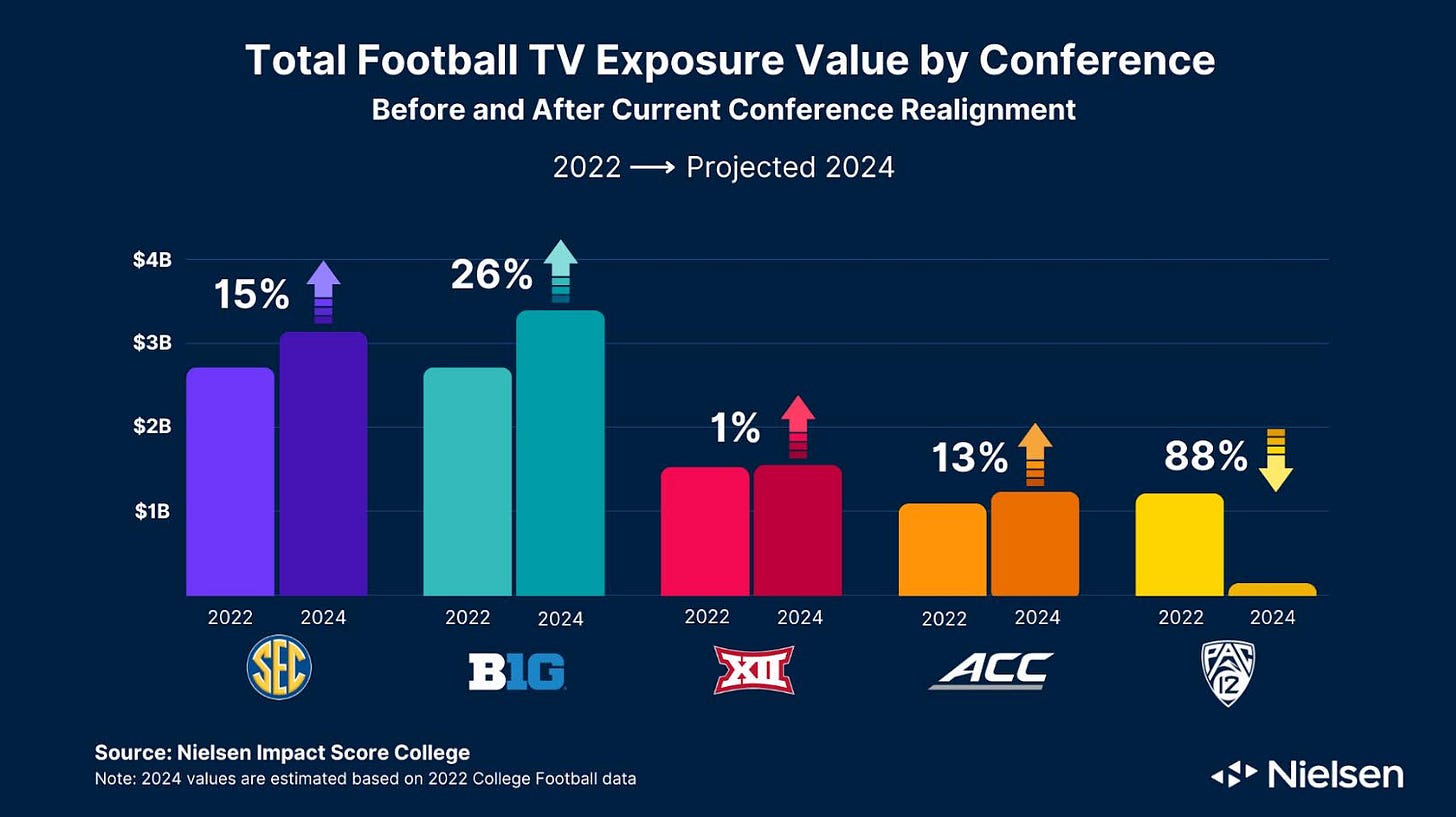

Almost every decision being made during this transformational time in college athletics is being driven by TV rights revenue. TAB breaks it all down for you here.

++

The past five years have brought unprecedented change to college athletics. Athletes, schools and fans have navigated a pandemic, seen the emergence of NIL and the transfer portal and have watched an unparalleled wave of conference realignment call into question everything they thought they knew about college sports. But as the NCAA continues to plead for a flailing Congress to involve itself in college athletics while facing a plethora of legal challenges, the rate of change for college athletics could still accelerate.

Through the chaos, one player has emerged as perhaps the primary driver of college sports’ New World Order: television, and the companies that provide it. The following is the first in a series that looks into the impact of media rights on college sports and athletes. We will break down the key historical moments, the importance of advertisers, the emergence of streaming services as a major player in sports, the future of TV rights for other college sports, and what it all means for college athletes in the new world order of big-time college sports. Let’s dive in.

The Supreme Court grants schools and conferences TV rights

The NCAA used to have full control over the television rights of college sports, and it severely limited schools’ appearances on TV with the hopes of driving attendance to live games. That changed in 1984, when in NCAA v. Board of Regents of the University of Oklahoma, the Supreme Court deemed that practice a violation of antitrust laws. Conferences and schools were from then on allowed to negotiate their own television rights deals.

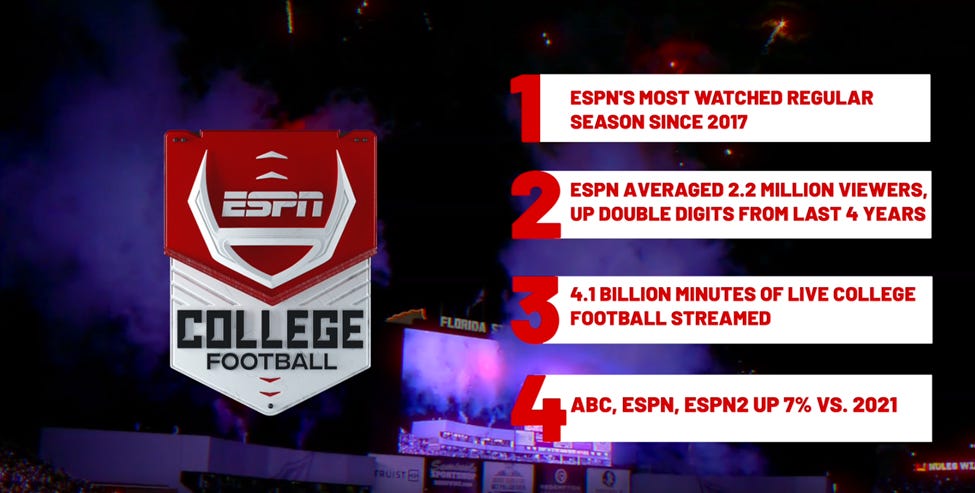

In the nearly four decades since, the rights to show college sports on television have become increasingly valuable. Several factors explain this appreciation for TV companies like ESPN (who is owned by Disney), Fox, CBS and others. For one, the emergence of college football as America’s clear second preference after the NFL, borne out by this season’s historically strong ratings. Moreover, the same TV companies have seen steep declines in ratings on non-sports content as streaming services like Netflix have taken a substantial share of the television market. This has put many TV companies in precarious financial positions, and has left sports as among the remaining properties available for “legacy” media companies to use to achieve revenue and growth.

David Albright, who oversaw the delivery of digital college sports content as part of a 25-year career at ESPN, said sports have become so important for companies that broadcast on linear (cable) TV because, unlike other TV programs, sports is still best consumed live.

“I think the reason why it's still so valuable, and that the media entities, whether they're traditional ones or not, want to be in the business, is because it's the closest thing to what's left of appointment viewing,” Albright said. “Sports is the ultimate reality TV. It’s live, it's unscripted, and you don't know how it's gonna play out.”

TV companies have two primary revenue streams: selling advertisements, and carriage fees from cable. Carriage fees are also media rights: payments made by cable companies like Cox and AT&T to TV networks for the rights to broadcast their content. The more people are watching a channel, the more a network can charge for both commercials and fees from cable companies.

Despite the industry disruption caused by the rise of streaming, linear TV can still generate significant revenue if companies get access to popular content.

“The traditional cable bundle still makes money. It's still a pretty good business,” Albright said. “It's not going away. Maybe somewhere down the road, but not in the immediate future… There's still a lot of money that's coming in.”

This leaves television companies with an enormous incentive to gain the rights to broadcast college sports, which materializes as cutthroat bidding wars and eye-popping contracts.

Media companies cash in on growth of college sports

Per Sports Business Journal, starting in 2024 the Big Ten, SEC and College Football Playoff media rights deals combine for nearly $2.5 billion per year paid out to conferences and participating schools. ESPN/ABC (both owned by Disney) currently holds the exclusive rights to the SEC and CFP, with Fox, CBS and NBC sharing the rights to the Big Ten. Beginning next year, the ACC (ESPN), Big 12 (ESPN/Fox) and Notre Dame (NBC) will combine for $635 million per year in media rights payouts.

These rights are often distributed via a Grant of Rights agreement between schools and conferences, in which schools cede the rights to their media rights to conferences, who sign deals with networks and/or streaming services. Usually conferences then distribute media rights payments evenly to member schools. In 2024, the SEC and the Big Ten (referred to by some as the “Power Two”) will receive around $70 million per year per school (with the exception of Washington and Oregon, who joined the Big Ten at a discounted rate), versus nearly $40 million for the ACC and around $31.6 million for the Big 12.

This massive fall allows schools to invest more into, among other things, increasingly elite facilities and higher salaries for coaches and administrators, all while further extending the gulf between the haves and the have nots in college sports.

Revenue remains unshared with athletes

Despite the billions of dollars worth of television money promised to Power Five conference schools over the next decade, that revenue is not currently shared with the athletes who generate it.

Until recently, compensation for college athletes was a black market, an open secret kept under the table. Due to the Supreme Court’s 9-0 decision in NCAA v. Alston, players can now profit off their name, image and likeness (NIL). But this has remained players’ only source of above-board revenue, and the scope of an athlete’s NIL opportunities are often dependent on an athlete’s independent fame or the strength of a schools’ NIL infrastructure. TV money, however, goes unshared with players while remaining an enormous income generator for universities and media companies.

The governance model and financial model of college athletics will continue to change, sometimes rapidly. Legal challenges currently facing the NCAA, such as House v. NCAA where all three damages classes were just certified and a National Labor Relations Board complaint filed against the NCAA, USC and the Pac-12, could make major disruptions to the current economic model of college sports by impacting the employee status and revenue-sharing capability of collegiate athletes.

Through the chaos, one truth will almost certainly persist: people love to watch college sports. And that’s going to make a lot of people money. The question is not if, but when will college athlete get their fair share?

Alex Wakefield is a Sports Journalism Master's student at Arizona State University. He is a digital reporter covering sports business with Cronkite News and a senior reporter with ASU's student newspaper, The State Press.

NIL Brand Deals

Brand deals we can learn from, brought to you by NOCAP Sports

TAB’s goal is to help athletes get paid. Here are some examples of recent college athlete deals that you can learn from and help you win the NIL game.

Angel Reese (WBB, LSU): Reebok

Joe Milton (QB, Tennessee Football) and Ladd McConkey (WR, Georgia Football): The Dairy Alliance

NIL For Good

Athletes that inspire us, brought to you by Groundswell

At TAB we are firm believers in doing well by doing good. Here are some examples of how you can turn your NIL wins into community wins.

Malachi Coleman, WR, Nebraska Football. Coleman is donating NIL earnings to kids in foster care inspired by his own experience growing up in foster care. Hear his story from him directly.

Rodney Gallagher, West Virginia Football. Gallagher is donating 100% of the proceeds from sales of his new Rodney Gallagher Official Fan Shirt to Morgantown Children’s Hospital to help kids in his community. T-shirts are on sale HERE ($30.00).